Tuesday Recap:

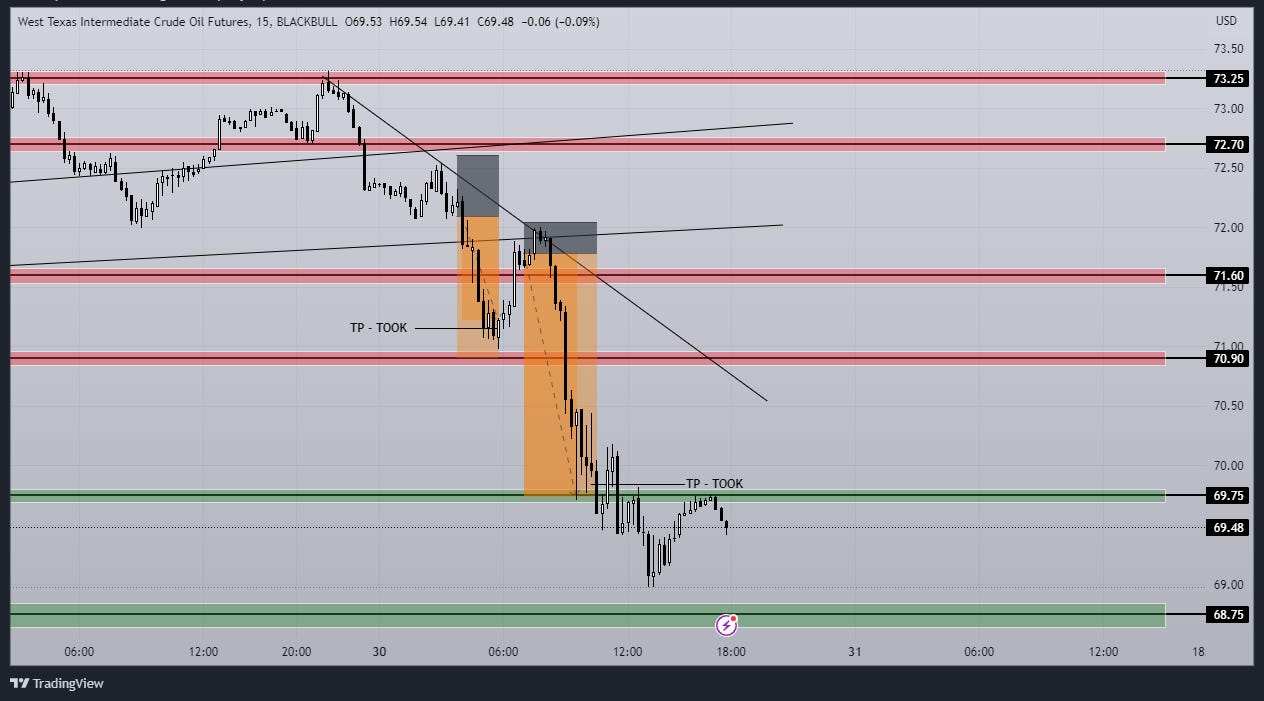

Crude Oil had an intraday high of 73.32 and a low of 68.98. The day’s range was $4.34, the widest yet! The selling from the 73.25 resistance began very early on and once US markets opened there was drastic selling. This was due to Oil breaking the 70.90 major support for the first time in two weeks.

The trade plan was in full force today as price was below the daily pivot so shorts were really profitable as we hit all of our targets. In the previous posts, I mentioned that the head and shoulder pattern would be likely if lack of buying was to persist beyond 73.25. That bearish structure is now complete.

Trade Plan!

Tomorrow is the last day of May, so I'm sticking with this trend as WTI will continue to gap down further provided it trades below tomorrow’s daily pivot (70.59).

Strong buying above 70.00, long to 70.59 (daily pivot) AND then the next resistances:

- 70.90 , 71.60 , 72.70 , 73.25

Strong selling below 70.59, short to the next supports:

- 69.80 , 68.75 , 67.50 , 66.40

Follow me on twitter: @TradingVoila

Thanks for making it this far, I hope to write to you again tomorrow.

Voila Trading