Monday Recap:

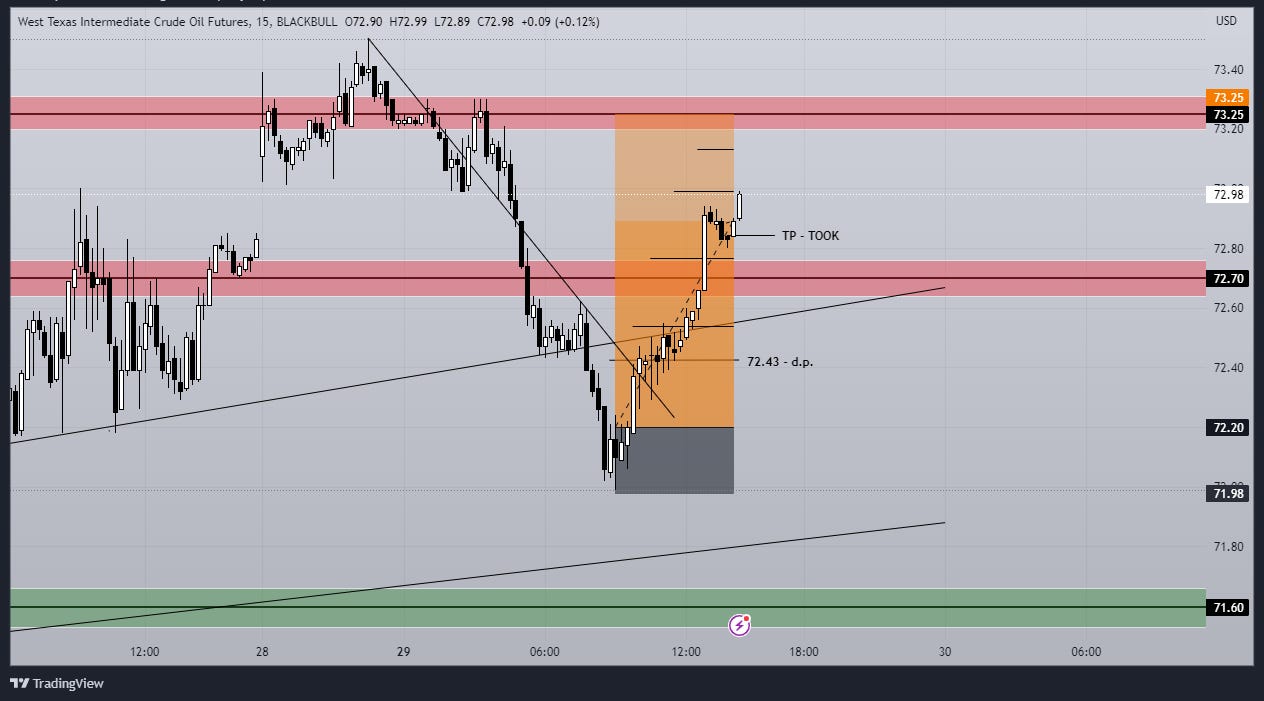

Crude Oil had an intraday high of 73.50 and a low of 71.99. Price slowly retraced from this low and closed at 73.00, which is an excellent starting point for the Bulls tomorrow.

If you missed the reversal trade shown below, take a look at the tweet I wrote, which shows how I use my trade plans as well as the overall insight in regards to certain levels that I frequently talk about.

It should be noted that today was a bank holiday hence the slow movements and lack of price action. As I said (more explicitly) in yesterday's trade plan, the strong support at 70.90 is what is keeping price from falling, however Bulls are still continually facing a tough challenge in trading above the 73.25 - 74.00 levels. This is my current view.

Trade Plan!

Strong buying above 72.50, then long to the next resistances:

- 73.25 , 74.00 , 75.00 , 76.05

Strong selling below 72.82 (daily pivot), short to the next supports:

- 72.70 , 71.60 , 70.90 , 69.75

Follow me on twitter: @TradingVoila

Thanks for making it this far, I hope to write to you again tomorrow.

Voila Trading