Understanding Oil Fundamentals: OPEC, geopolitics, economics

How to make sense of oil's fundamentals - Notes by Voila

Quick Notes

Unlike the multitude of country-specific economic indicators in forex, oil’s price is driven by universal supply and demand dynamics that are easy to follow.

Of course, this dynamic is influenced by major players of this precious commodity.

So it’s crucial to understand what these players are doing, gaining deeper insights into what we're actually trading day in, day out.

This article includes:

an in-depth overview of OPEC and major oil producing countries

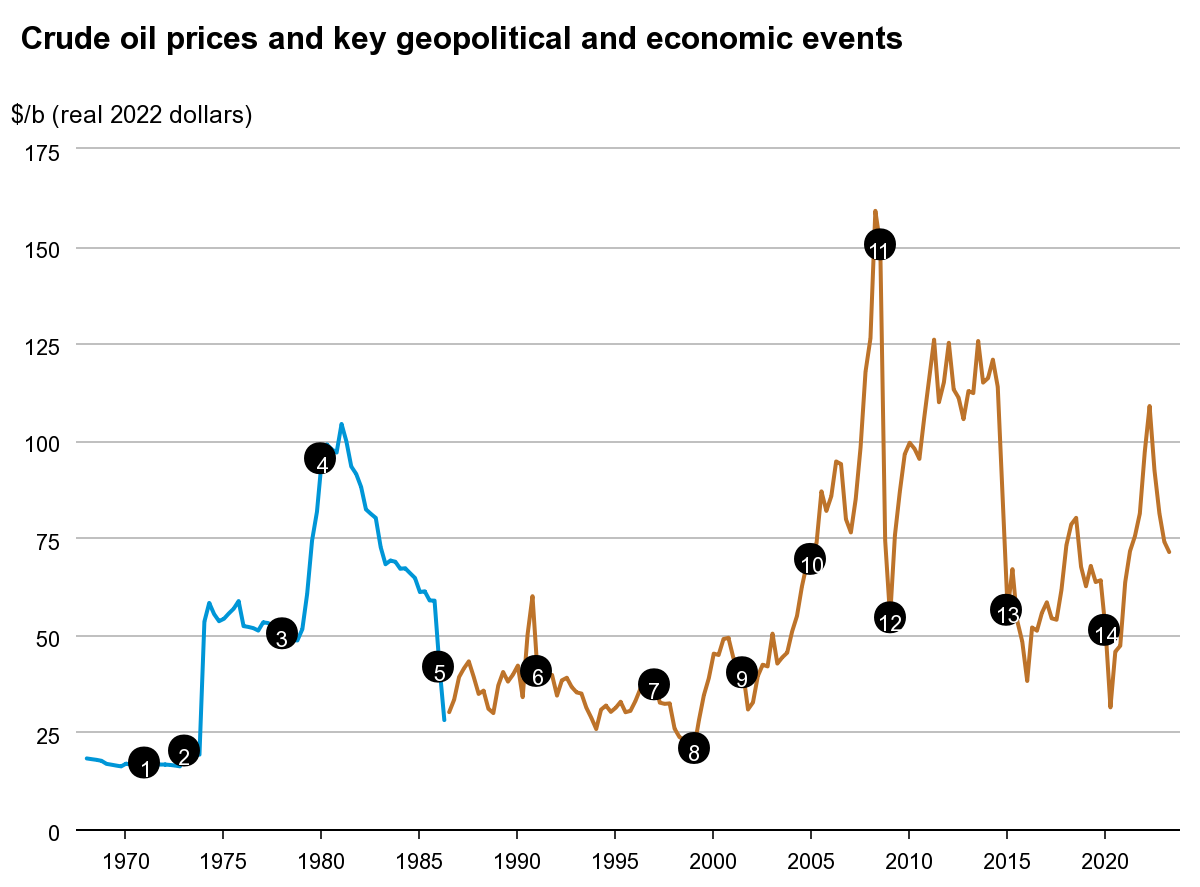

impact of geopolitical / economic events on crude oil price

How Does OPEC Work?

OPEC consists of 13 countries that are major oil exporters.

They aim to manage the global supply of oil through production quotas that are agreed upon for each member, thus setting the price of oil.

They help avoid fluctuations that might affect the economies of countries producing or buying oil.

OPEC is a high level organization.

Producing more than 40% of the world's crude oil, and their exports, which represent 60% of the total petroleum traded internationally - their collective influence allows them to dominate a substantial share of the global oil market and respond to changes in supply and demand more effectively.

If they were publicly traded, you wouldn’t think twice about buying OPEC shares because as we know oil is finite and they have a lot of it:

(1.243 trillion barrels / 1.564 trillion barrels) * 100 = 80% of proven world oil reserves in OPEC’s hands.

There are 10 OPEC+ countries.

This alliance was created in 2016 in response to the boom in U.S. shale oil production, which caused declining oil prices due to oversupply.

The major exporters obviously didn’t like this. So both OPEC and OPEC+ agreed to cut oil production to address the oversupply and support prices.

OPEC will continue to adjust production levels through various agreements, responding to changing market dynamics and other challenges.

Another example was in 1973, when OPEC decided to stop sending oil to the U.S. for their support of Israel.

This was named the “Oil Embargo of 1973–1974” and price quadrupled!

Ranked: Oil Production By Country (2022)

The top oil producers have been ranked below.

Just these 10 countries accounted for 73.7% of the world’s oil production.

The U.S. has been the world’s biggest oil producer since 2018 and maintained its dominance in 2022 by producing close to 18 million B/D. This constituted almost one-fifth of the world's oil supply.

Why is U.S. the top producer?

- They’ve been the largest consumer of oil - 19 million B/D in 2022.

- The “Shale Revolution” enabled them to increase production of oil and natural gas dramatically over the years to meet growing demand.

Saudi Arabia, which historically has been the largest oil exporter in the world, produced 12 million B/D, accounting for about 13% of world supply.

Russia came in third with 11 million B/D.

An interesting fact about Russia is that they have a lot of unexplored oil and gas projects that lie in the harsh, cold climate of Northern Siberia / Arctic - perhaps they’ll see the #1 spot in the future.

Many countries, especially those heavily reliant on oil exports, will continue to produce more oil to meet both domestic and global demand.

Increasing production will always decrease Crude Oil price in the short term. However, in the long run, more demand growth will increase prices.

Oil Reserves

Although the U.S. produces the most, they are beat by other nations in terms of proven oil reserves - Venezuela, Saudi Arabia and Iran are just a few to mention.

In most databases, these proved reserves are referred to as “Crude Oil including Lease Condensate” reserves. They describe the amount of hydrocarbon resources that can be recovered from deposits with a high level of certainty.

Oil & gas companies with a higher number of proven reserves will have an edge over others as well as a higher share price.

Geopolitical Events Drive Oil Prices Higher

When there are geopolitical conflicts or sanctions on an oil-producing country, it can mess up the supply chain, thus making oil supplies uncertain.

This causes prices to shoot up.

As an oil trader, I see many of these events happening throughout, and it’s best to not enter longs just because of a geopolitical event, because so much goes on during intraday trading and you’re most likely late to the move. Most initally sell the news anyway!

Economic Events Move Oil Prices Lower

Most economic events usually cause a downward spike, since they mainly disrupt the demand for oil.

For instance, in April 2020, there was a sudden drop in petroleum demand due to the global response to the pandemic, resulting in WTI dropping to -$37 a barrel.

While many believed that oil demand might not recover after such a collapse, experienced traders were buying the dip because they understood the limited significance of this short-term price action.

Leading up to this, OPEC and its allies (including Russia and the U.S.) agreed to reduce oil production by 9.7 million B/D - the largest production cut ever - which stabilized the market again.

Terrorist attacks are also uniquely classified as economic events, given that the direct damage incurred on the economy can be substantial.

Immediately following the 9/11 attacks in 2001, it was primarily the indirect costs of terrorism that caused a demand shock, driven by the loss of general consumer and investor confidence in the U.S. economy.

One can imagine the disruption this caused, as businesses stopped running momentarily and there was a serious halt to overall money flow.

Closing Notes

All of the fundamentals behind crude oil trading were covered and they literally don’t mean a thing if you just trade the charts! (honestly)

However, this informative overview whispers the need for traders and industry participants to stay vigilant and adapt to the dynamics of the oil market. And it will definitely help you understand it’s long-term price action better, as well as give you the most up-to-date knowledge about oil’s major players.

Moreover, many of the statistics shared should tell you how powerful oil is in influencing a lot of things…

Thank you

It is amazing to see OIL fall sharply in the last month, esp when the analysts were predicting 90$b. Approaching 60+ now.