The #1 Trader Hack

How to become a successful trader - Notes by Voila

Quick Notes

Individuals who consistently profit from the markets are more serious about trading than the average trader may think.

More importantly, they realize that any long-term success can only be attributed to having strong mental capabilities that essentially do the work for them.

But how exactly is this achieved? What are the specific habits that will allow you to become better at trading?

This article includes:

An overview of how to trade with a successful mindset and understanding how the average (losing) trader behaves

Undervalued ways to boost profits and reduce risk

Exploring a perspective that provides an edge to anyone and can be implemented right away

How the Crowd Trades

In essence, most retail traders aim for quick profits. They wake up fixated on daily profit targets, misinterpret simple price action, and, ironically, some even seek trading alerts.

In recent years, there's been an increase in new traders who, like the majority, haven't dedicated enough time to analyzing charts and executing their system.

The chart for the r/daytrading subreddit reveals a significant 3930% increase in subscribers since March 2020, reflecting an additional 2 million people showing interest in day trading on this platform alone.

Notably, the most significant jumps in subscribers occurred during turbulent market periods, including geopolitical wars and huge shifts in the U.S. monetary system.

It's fair to assume that many joined to profit from opportunities arising from these events, and a significant number likely got hooked and still continue to trade their lives away today.

Whether or not you fall into this group, understand this crucial message:

Not adopting a long-term perspective is the biggest mistake a newcomer to the markets can make because successful traders possess strong emotional discipline, which has been built by multiple years in the industry.

Trading Effectively

Intelligence isn't a factor in becoming a successful trader, otherwise there would be a lot more people making money.

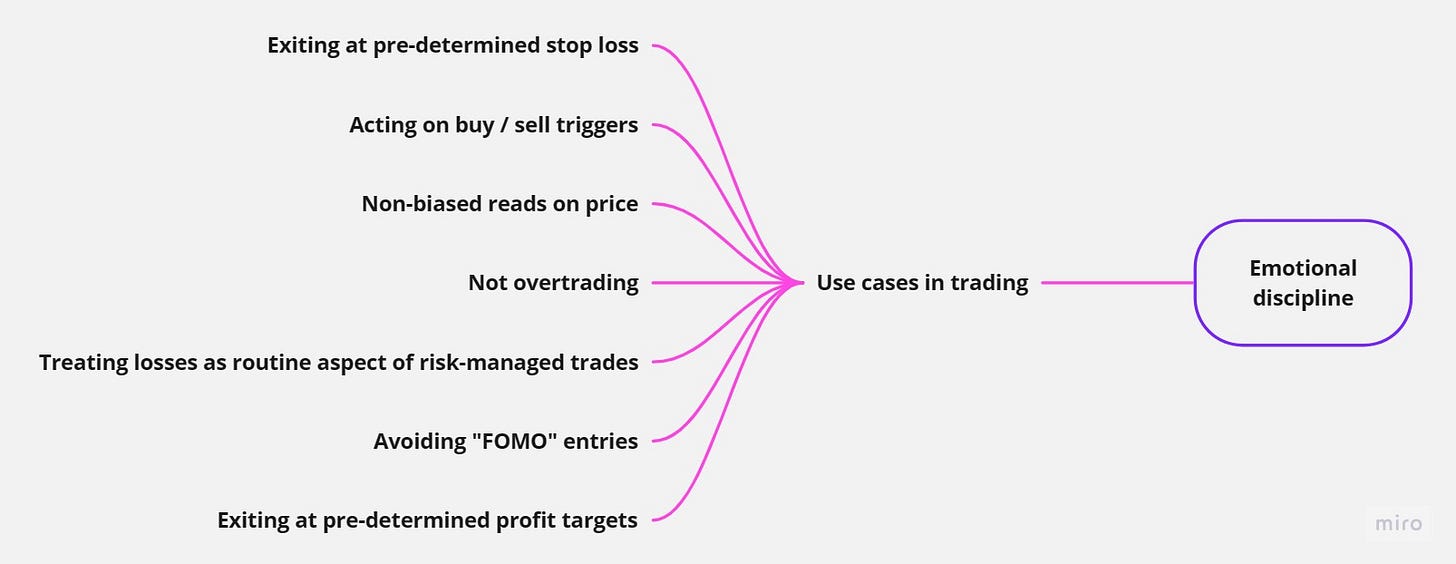

Things like inconsistent execution of your trading system or not recognizing when to enter or exit trades results from a lack of emotional discipline. The above list highlights specific areas where this discipline is essential in a trader’s life.

Emotional discipline is the ability that lets a person effectively control the emotions that that they are designed to feel and it applies heavily into trading since it's crucial to dismiss harmful emotions that lead to poor decisions.

The Progressive Approach to Earning More

A losing trade should never inflict a substantial blow to your account and you shouldn’t be losing more than a pre-determined amount.

Successful traders can assess the risk, and since their trading style is typically singular, they mentally note down an acceptable loss for ANY trade.

Here’s an oversimplified scenario:

If you initiate a $1000 short, whether or not price moves against it, set a stop loss to limit the loss to no more than 3%, equivalent to $30.

This strategy is very appropriate for day traders with a decent average profitability per trade (AAPT), who frequently seek to capture strong moves.

An increasing AAPT signals a trader's progression and an improved ability to identify rewarding opportunities to execute their system. This, combined with the practice of only incurring small losses, creates an ideal scenario.

Therefore:

Minimizing losses not only reduces risk but, over time, contributes to better profitability, as the progressing trader continues to profit significantly more.

Positioning Yourself Favorably (right away)

As this write-up concludes, it's essential to shed light on an often-overlooked edge that commonly discussed strategies fail to emphasize. The key is aligning with higher probabilities.

This involves:

Understanding the higher timeframe bias

Only trading the directional move of the day (up or down)

Avoiding high-risk, low-reward trades by recognizing the limited significance of short-term price action

By adopting some of the three principles mentioned above, a natural edge is gained. This requires an understanding of price action, so don’t be fooled by the simplicity of this approach.

As an oil trader, I implement these into my trade plans, making WTI/CL trading more simple & profitable. See about page for examples.

Closing Notes

Long-term success in trading relies on concrete actions.

Key things include managing emotions through the implementation of emotional discipline and a commitment to good habits. Essentially making decisions based on probability, not emotions, and consistently executing day in, day out to practice these principles.

Level up or consider a different path.

Great article. Thanks.

This is a nice piece of editing. Good article, and not ”too much” stuff :)